Portfolio

221(d)4 Projects

Highland Park

This LEED Gold certified, mixed use project included 125 residential units as well as a Corepower Yoga studio and their corporate offices. Built to maximize light, space and storage, this project located in the up and coming area of LoHi in Denver, CO was completed in 2012 and sold in 2016.

Denver, CO

- Status

- Closed

- Number Of Units

- 125

- Total Project Cost

- $19,904,600

- D4 Equity Contribution

- $4,285,000

221(d)4 Projects

Laurel View

With 174 luxury apartments, this project in the growing suburb of Concord, NC is the one that started D4 Equity. Almost 3 years to the day, the property was sold and all investors realized their expected returns in spite of underground rock that caused cost overruns early on in construction.

Concord, NC

- Status

- Closed

- Number Of Units

- 174

- Total Project Cost

- $23,556,452

- D4 Equity Contribution

- $3,200,000

221(d)4 Projects

The Reserve at Gashes Creek

This 190 unit multifamily Class A project is in the strong and growing market of Asheville, NC. In spite of construction delays due to Covid and significant infrastructure improvements necessary because of the challenging site, this property sold in February 2022 producing returns that exceeded expectations. All C.O.'s had been issued and the project was almost 100% leased at closing. The hold period was 3 years and 9 months.

Asheville, NC

- Status

- Closed

- Number Of Units

- 190

- Total Project Cost

- $32,200,000

- D4 Equity Contribution

- $5,600,000

221(d)4 Projects

Graces Reserve Apartment Homes

This project located in the suburb of Kannapolis, NC, just 26 miles northeast of Charlotte was recently sold. From loan closing to completion was an impressive 25 months. The project was finished on time and almost 100% occupied by the end of February when ownership changed hands. Returns to our investors far exceeded expectations on this investment.

Kannapolis, NC

- Status

- Closed

- Number Of Units

- 240

- Total Project Cost

- $42,820,400

- D4 Equity Contribution

- $7,400,000

221(d)4 Projects

Eldorado Springs Apartments

This planned luxury apartment community has many amenities and a great location southwest of downtown Colorado Springs. The brand new one, two and three bedroom units will be in high demand as there has been no new development in this area for many years. Construction is underway!

Colorado Springs, CO

- Status

- Active

- Number Of Units

- 236

- Total Project Cost

- $60,000,000

- D4 Equity Contribution

- $6,200,000

Other Multifamily Investments

Ridgeland Ranch

Purchased off market in late 2018, this undervalued asset located in Jackson, MS was in need of TLC. Upgrades to unit interiors, landscape and security features as well as implementation of professional management and policies have resulted in higher occupancy rates and rents are now on par with the competition.

Ridgeland, MS

- Status

- Closed

- Number Of Units

- 137

- Total Project Cost

- $13,000,000

- D4 Equity Contribution

- $600,000

Other Multifamily Investments

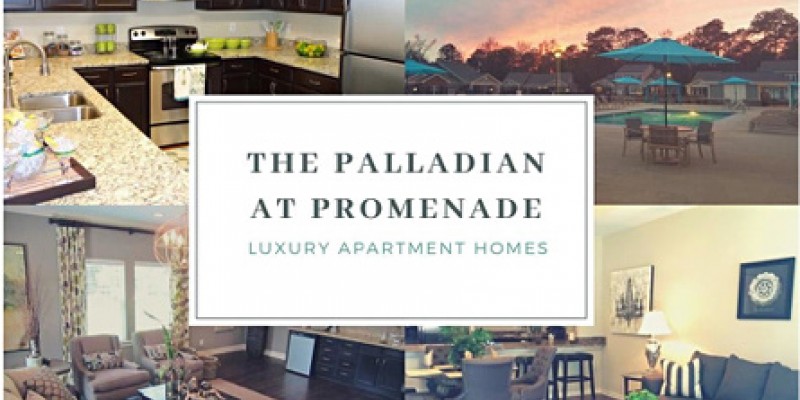

The Palladian at Promenade

Located near Huntsville, Alabama, this luxurious, amenity loaded project has 110 units and a unique design for an apartment community. The units are side by side and have attached garages so they look more like a townhome community with the advantage of only one shared wall.

Madison, MS

- Status

- Closed

- Number Of Units

- 110

- Total Project Cost

- $18,689,000

- D4 Equity Contribution

- $400,000

Other Multifamily Investments

Portside Villas

D4 Equity purchased a 50% interest in this 144 unit property located in Ingleside, just 18 miles west of Corpus Christi, TX. The units had recently been remodeled and the deal was considered a relatively low risk investment because the property was already stabilized with below market rents and a 3.85% interest rate on a loan with 33 years remaining.

Ingleside, TX

- Status

- Active

- Number Of Units

- 144

- Total Project Cost

- $8,400,000

- D4 Equity Contribution

- $1,525,000

Other Multifamily Investments

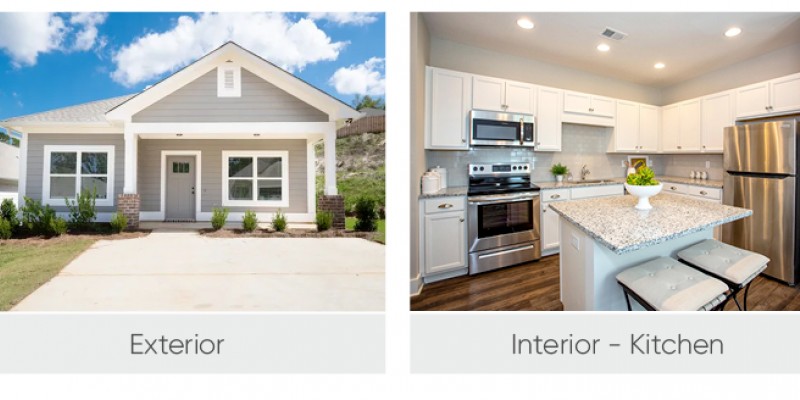

Walnut Grove

Walnut Grove is a luxury community built in Seguin, Texas offering one, two and three bedroom apartments with designer finishes and generous square footage. The property is near shopping, schools and entertainment so residents enjoy easy access to nearby services and amenities.

Seguin, TX

- Status

- Closed

- Number Of Units

- 116

- Total Project Cost

- $13,281,500

- D4 Equity Contribution

- $1,600,000

Other Multifamily Investments

River Road Terrace

This property, located near a large university and downtown Petersburg, Virginia was showing it's age... but only on the outside! With only one floor plan option, all of the 2 bedroom/2 bath unit interiors had been recently updated. The undervalued asset was only in need of some extensive exterior renovations to increase its marketability and value.

Petersburg, VA

- Status

- Closed

- Number Of Units

- 128

- Total Project Cost

- $10,750,000

- D4 Equity Contribution

- $350,000

Other Multifamily Investments

Residences at the Overlook

The purchase of this underperforming property in Little Rock is the fourth acquisition/rehab project in our portfolio. We are bringing this 90's asset up to date and up to par with its neighbors by upgrading unit interiors, installing a professional management team and re-branding the property. Together with active ownership, we'll be able to increase rent levels and returns.

Little Rock, AR

- Status

- Active

- Number Of Units

- 258

- Total Project Cost

- $14,454,000

- D4 Equity Contribution

- $3,950,000

Other Multifamily Investments

Highland Lakes Apartments

This vintage asset is ripe for renovation! Located in a highly attractive neighborhood near Montgomery, the property benefits from a booming economy and the #1 school district in the area. Poor operations and dated interiors lead to an off market purchase price at levels far below local comparables.

Prattville, AL

- Status

- Closed

- Number Of Units

- 224

- Total Project Cost

- $28,967,000

- D4 Equity Contribution

- $2,200,000

Other Multifamily Investments

Cornerstone Fund 30

Cornerstone Fund 30 is a multifamily acquisition-rehab fund targeting tertiary markets in the South Eastern U.S. We are confident that over the next 2 to 3 years, our partner's experience and strategy of finding exceptional opportunities will result in attractive returns to our investors. The first asset purchased is located outside Birmingham, AL and the second, purchased in December 2022, is located in Greenville, SC.

- Status

- Active

- Total Project Cost

- $25,000,000

- D4 Equity Contribution

- $3,200,000